Investment Philosophy

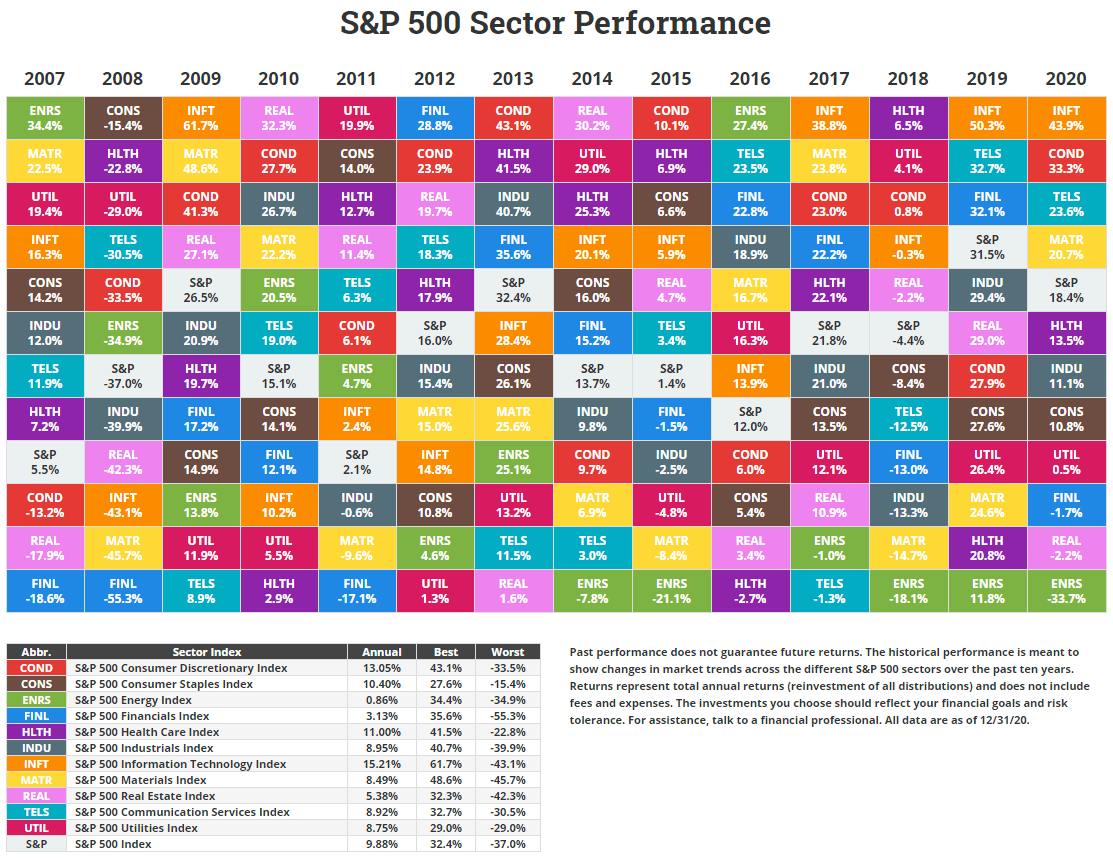

Source: novelinvestor.com

Source: novelinvestor.com

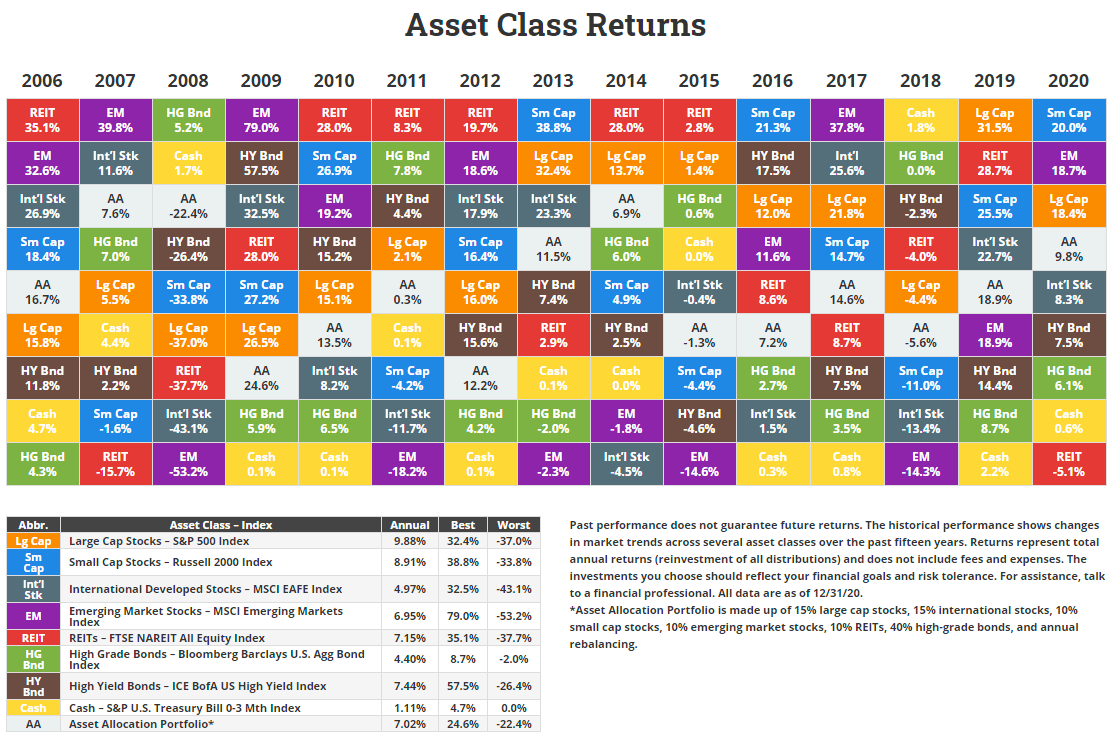

Source: NovelInvestor.com

Source: NovelInvestor.com

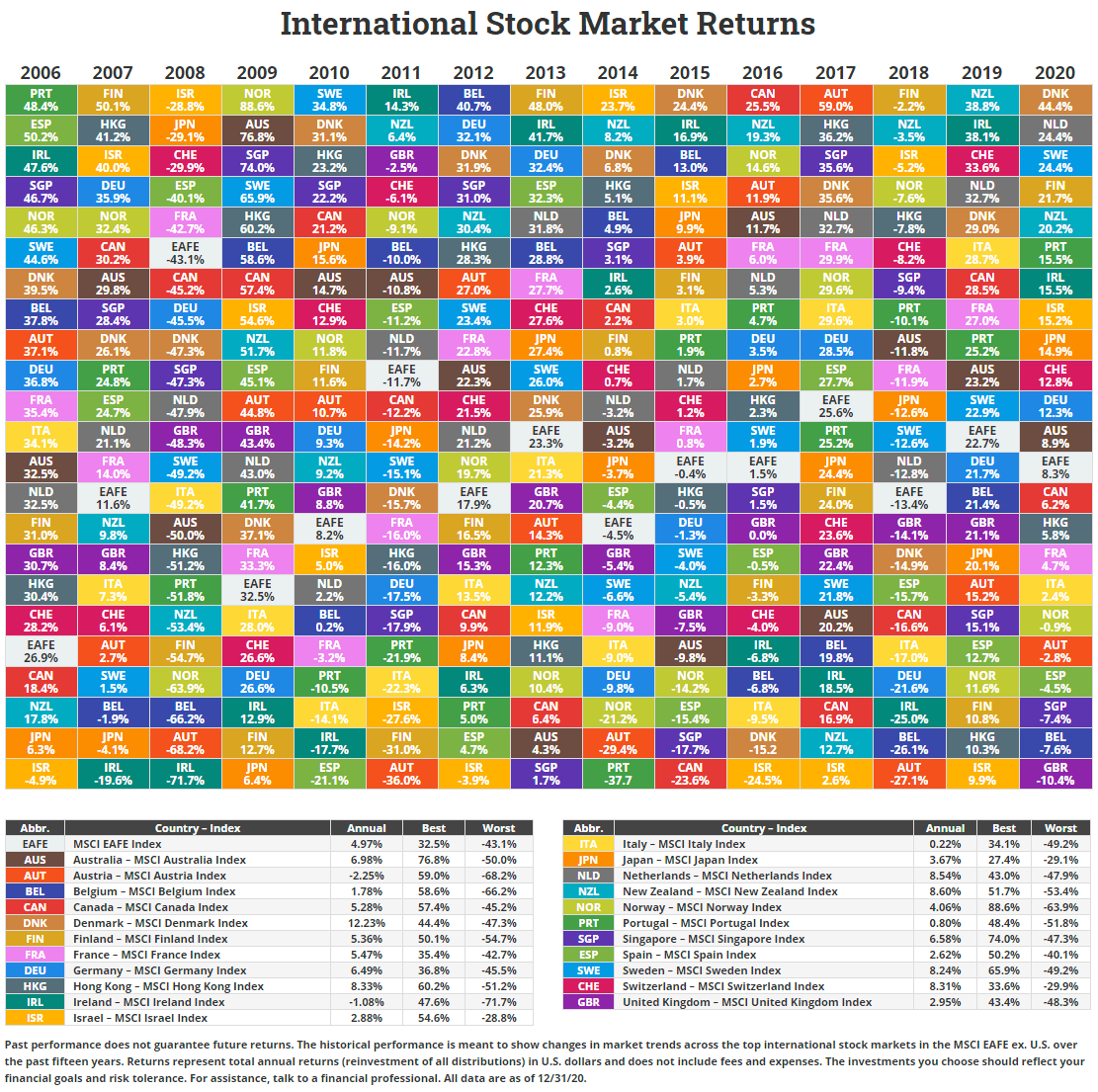

Source: novelinvestor.com

Source: novelinvestor.com

Source: Novel Investor

Source: Novel Investor

Can You Predict When to Buy and Sell Stocks?

Can investors predict when to buy and sell securities? Jim Davis, PhD runs more than 780 tests on data from 15 stock markets to test this theory.

The Power of Markets

Curious about how markets work? This video explains how security prices are set and how they change based on the collective knowledge of buyers and sellers. Armed with this information, investors will better understand how and why markets work.

Markets Rewarding Discipline

Jake DeKinder, Head of Advisor Communication at Dimensional, explains how capital markets have rewarded investors that are able to tune out short-term noise and stay disciplined over the long-term.

Tuning Out The Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong emotional responses from even the most experienced investors. Headlines from the so-called lost decade–the 2000s, when the S&P 500 ended below where it began–can help illustrate several periods that may have led market participants to question their approach.

Staying In Your Seat

The impact of missing just a few of the market’s best days can be profound, as shown by this animated look at a hypothetical investment in the stocks that make up the S&P 500 Index.

Market Volatility

Jake DeKinder, Head of Client Communications at Dimensional, explains why investors should view recent market declines as part of the nature of investing.

The Power of Professional Advice

Dimensional Founder David Booth shares his perspective on the value of professional advice. In an uncertain world, financial advisors help you make informed decisions to pursue your goals.

Advantages of Working with Advisors

David Booth and Robert Merton discuss a financial advisor’s role in helping individual investors use Dimensional strategies.

How We Design Portfolios

Kenneth French explains the key objectives that shape Dimensional’s approach to portfolio design.

Applying Science to Investing

An introduction to Dimensional for investors, this video underscores how science has transformed every aspect of our lives, including investing.

Dimensional Investing

David Booth, Dave Butler, Eugene Fama, John McQuown, and Ken French explain the deep connections between academic finance and Dimensional’s approach to investing and how the firm’s focus on data and implementation, and its ability to adapt as research evolves, helps investors.

Why Should I Invest?

Nobel laureate Eugene Fama explains two key steps to investing: knowing why you want to invest and understanding your tolerance for risk.

Reacting to Markets

Nobel laureate Eugene Fama provides perspective for long-term investors on why they shouldn’t pay a lot of attention to short-term results.

What's the Upside of Risk?

Nobel laureate Eugene Fama discusses how financial markets work, what fuels innovation, and the upside and downside of risk.

Global Diversification

David Booth speaks on global diversification, highlighting its role in avoiding extreme investment outcomes and emphasizing the importance of staying the course over the long term.

Eugene Fama on Modern Finance

University of Chicago Booth Professor and Nobel prize winning economist Eugene Fama talks about the evolution of modern finance.

Paradigm Advisors is a fee-only financial planning firm based in Dallas, Texas and Fayetteville, Arkansas. Paradigm Advisors provides comprehensive financial planning and investment management services to help clients organize, grow and protect their wealth throughout life’s journey. Paradigm specializes in advising young professionals and entrepreneurs in the early stages of life and well-established career executives through financial planning and investment management. As a fee-only fiduciary and independent financial advisor, Paradigm never receives commission of any kind. Paradigm is legally bound by certification to provide unbiased and trustworthy financial advice.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Nothing on this website shall constitute or serve as an offer to sell products or services in any country or jurisdiction by any Dimensional global firm. For informational purposes only. All information is given in good faith and without warranty and should not be considered investment advice or an offer of any security for sale.